Shelagh Fogarty 1pm - 4pm

23 March 2023, 18:13 | Updated: 23 March 2023, 18:26

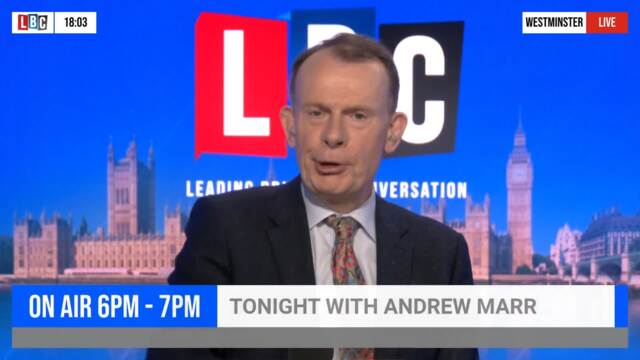

Andrew Marr has said that away from the drama in Westminster, Brits face the more serious problem of rising inflation, after official figures showed it jumped unexpectedly to 10.4 percent in February.

Speaking on LBC's Tonight with Andrew Marr, the presenter said that the surprise jump - despite Rishi Sunak's pledge to bring inflation down - will, unlike the twists and turns of the Partygate drama, have a profound and visceral effect on UK households .

"Yesterday we spent a lot of the show talking about Boris Johnson in front of a Commons committee. Today we turn to something serious; something affecting you.

"Inflation is supposed to be going down. That’s a Rishi Sunak promise. But this week we learnt to general shock that it's still going up.

Andrew Marr on inflation rates still rising

Watch Tonight with Andrew Marr exclusively on Global Player every Monday to Thursday from 6pm to 7pm.

"It’s now at 10.4 percent, giving Britain the highest inflation rate of any of the advanced economies. You're going to notice that.

"We’re told that higher British inflation is caused by the cost of fruits and vegetables. But that can’t explain the particular British problem. Don't they eat salad in France?

"I'm sure I saw potato salad last time I was in the States. Anyway, earlier today the Bank of England responded by raising interest rates for the 11th time in a row to 4.25 percent.

"If you have a mortgage or otherwise borrow money, you're going to notice that. Now you might have heard an economist on this show earlier in the week saying she thought this would be a difficult decision for the Bank of England.

"And you might wonder why? After all, the Bank’s job is to keep inflation under control and you do that by raising interest rates. Where's the problem?

"Well, in part, because it makes life harder for ordinary folk. But also because there is a banking problem becoming visible around the world, so far not here but in the United States and Switzerland.

You can also listen to the podcast Tonight with Andrew Marr only on Global Player.

"It seems to have been provoked by the pressure of higher interest rates on the banking system. Some commercial banks put a lot of their depositors’ money into bonds - theoretically safe - but as interest rates go up, the price of bonds - the value of bonds, - goes down.

"So if you're a bank and you’ve bought lots of them, assuming you live forever in a world of low interest rates, and interest rates start to go up, you might suddenly find a nasty black hole on your balance sheet.

"That’s what happened to that American Silicon Valley Bank which collapsed earlier in the month. Now there is no sign of trouble in the British banking system but we've got lots of banks and if the same trouble turned up here everyone listening tonight would certainly notice that.

"We know from what happened 15 years ago that banking has few borders; there is no such thing as plucky national independence in the banking world.

"Now when I'm talking about politics I often use slightly fruity, dramatic language - for fun, really - but as I said this subject’s too serious for that."