James O'Brien 10am - 1pm

23 September 2022, 09:12

'This is going to alienate people.'

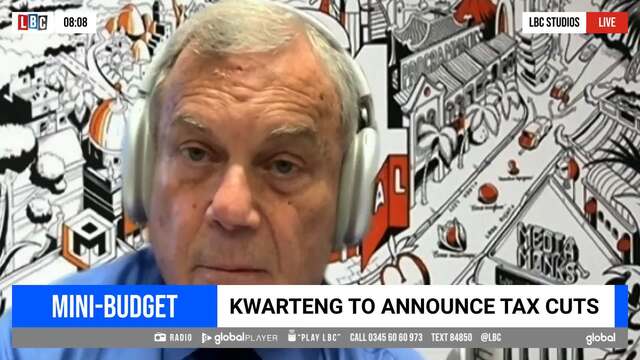

Scrapping the cap on bankers' bonuses will "alienate" people from the Conservative party and will not help them get re-elected in two years' time, Sir Martin Sorrell has told LBC's Nick Ferrari at Breakfast.

Sir Martin, founder and Executive Chairman of S4 Capital and founder of WPP - the world's largest advertising and PR group - told Nick removing the cap on bankers' bonuses is a good strategy "long term" but doing it now was a big mistake.

"I'd agree... long term," he said when Nick asked whether he agreed with Lord Michael Spencer, who told LBC two weeks ago that removing the cap on bonuses was a key benefit of Brexit.

"But to do it now, two years in front of an election... Michael Spencer wants to re-elect the Conservative party.

"This is not, in my view, going to work.

"This is going to alienate people."

'This pits the Chancellor of the Exchequer against Bank of England'

Sir Martin said the UK was at war with Russia, both economically and militarily, and the government "can't keep on spending like this".

"We are at war in the real sense, militarily, and we are at war economically," he said.

"Energy prices are going to stay and we have to deal with that... we have to batten down the hatches.

"We can't keep on spending like this... where's all this money going to come from?"

"The numbers don't add up," he said,

"Record borrowings, record cost of borrowings, interest rates are going to rise, the government's going to have to fund it.

"It doesn't compute."

Sir Martin also said there was a "disconnect" between what the right thing to do is and what Tory donors want.

"The people that fund the Conservative Party want to see these sort of things happen and I think there's a disconnect between what is the appropriate political approach and what fundraisers, or people who provide funds, want to see," he said.

Chancellor Kwasi Kwarteng is delivering a 'mini Budget' on Friday to outline new his and Prime Minister Liz Truss' plan to tackle the looming economic crisis.

He is set to tell MPs that a "cycle of stagnation" has led to the biggest tax burden Britain has experienced since the 1940s.

As well as the removal of the cap on bankers' bonuses, Mr Kwarteng's strategy it expected to involve cutting corporation tax, scrapping Rishi Sunak's national insurance hike, the establishment of low-tax investment zones, a stamp duty cut and a tightening of the rules around Universal Credit.

However critics fear high spending and lower taxes could lead to heavily increased borrowing.

The Institute for Fiscal Studies said the growth strategy was "a gamble at best", and Labour said the Conservatives "don't have a new plan for economic growth".