Richard Spurr 1am - 4am

23 September 2022, 09:44 | Updated: 14 October 2022, 13:30

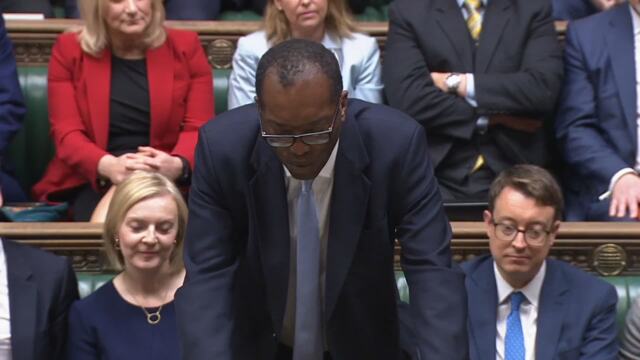

Chancellor Kwasi Kwarteng has slashed taxes and removed the cap on bankers' bonuses in a bold mini Budget designed to help the government and the country tackle the cost of living crisis.

Mr Kwarteng told MPs in the House of Commons high taxes reduce the "incentive to work" and announced cuts to income tax, stamp duty, national insurance and corporation tax.

The basic rate for income tax will be cut to 19p from 2023, and the 45p top rate will be abolished altogether.

Mr Kwarteng said it would "simplify the tax system and make Britain more competitive".

"It will reward enterprise and work. It will incentivise growth. It will benefit the whole economy and the whole country," he said.

The stamp duty threshold will be doubled to £250,000 - and for first time buyers, the threshold will be upped from £300,000 £425,000.

The changes to stamp duty come into effect today.

Read more: Kwarteng scraps rise in alcohol duty with punters saving 7p on a pint and 38p on a bottle of wine

Read more: Higher rate of income tax axed for top earners and 1p cut for all amid biggest tax cuts since 1972

Meanwhile the hike to national insurance will be reversed to break a "cycle of stagnation".

Mr Kwarteng said the national insurance cut would come into effect on November 6, and that the additional funding for the NHS and social care sector - what the national insurance levy was for - would be "maintained".

A planned increase in corporation tax - from 19 to 25 per cent - has also been scrapped.

It is the biggest tax-cutting budget since 1972, according to Institute for Fiscal Studies (IFS) director Paul Johnson.

Mr Johnson said he hoped today's budget works better than the last comparable budget that "ended in disaster".

£45 billion of tax cuts. This is biggest tax cutting event since 1972. Barber's "dash for growth" then ended in disaster. That Budget is now known as the worst of modern times. Genuinely, I hope this one works very much better.

— Paul Johnson (@PJTheEconomist) September 23, 2022

The Chancellor also removed the cap on bankers' bonuses, saying the UK economy depended on a "strong financial services sector".

"All the bonus cap did was to push up the basic salaries of bankers or drive activity outside of Europe," he said.

"So let's not sit here and pretend otherwise.

"So as a consequence of this, Mr Speaker, we are going to get rid of it."

The rise in National Insurance will be reversed from November 6

Mr Kwarteng also announced a tightening the rules for those claiming Universal Credit, saying they need to take "active" steps to look for work.

"Growth is not as high as it should be," he said, opening up his speech to MPs in the House of Commons, adding high taxes were "hampering growth".

"We are determined, Mr Speaker, to break that cycle."

He went on: "We will focus on growth even where that means taking difficult decisions."

He also introduced new 'low-tax investment zones' to target more deprived local areas. This aims to liberalise planning rules in specific areas of the UK and target local economic growth.

'We will make work pay by reducing people's benefits.'

Speaking after Mr Kwarteng's speech, Shadow Chancellor Rachel Reeves hit out at plans to fund the strategy by borrowing and said "working people are left to pick up the bill".

"The Chancellor has confirmed that the costs of the energy price cap will be funded by borrowing, leaving the eye-watering windfall profits of the energy giants untaxed," she said.

"The oil and gas producers will be toasting the Chancellor in the boardrooms as we speak while working people are left to pick up the bill.

"Borrowing higher than it needs to be, just as interest rates rise.

"And yet the Chancellor refuses to allow independent economic forecasts to be published, which would show the impact of this borrowing on our public finances and growth, and on inflation.

"It is a budget without figures, a menu without prices.

"What has the Chancellor got to hide?"

Ms Reeves accused the Government of replacing levelling up with "trickle down" - a strategy she said is "discredited, it is inadequate and it will not unleash the wave of investment that we need".

She added "Labour believes in wealth creation" but that the Government is piling the "crushing weight" of costs on taxpayers.

'We're going to get rid of the cap on bankers' bonuses' - Chancellor

Conservative former ministers have expressed worries about the tax-cutting agenda laid out in the statement.

Conservative chair of the Treasury Select Committee Mel Stride said the statement had a "vast void at the centre" because of the lack of a forecast by the independent Office for Budget Responsibility (OBR).

Former Treasury minister John Glen said there were "irreconcilable realities" in the plans, as interest rates and inflation were rising at the same time the Government plans to borrow more cash to fund tax cuts.

Read more: Pound plummets to 37-year low after Kwarteng unveils 'growth plan' for economy

Meanwhile the Chancellor's decision to axe the cap on bankers' bonuses - which has been capped at 100 per cent of their salary, or double with shareholder approval - has been met with backlash amid fears it will see the return of a "culture of greed" in the City.

Michael Barnett, a partner at Quillon Law and who led litigation involving high-profile banking scandals following the 2008 crisis, said: "To many who were scarred by the consequences of the 2008 global financial crisis and the banking scandals that accompanied it, news that caps on bankers' bonuses may be abolished will trigger a response bordering on visceral.

"Bankers' bonuses were seen as emblematic of an imploding financial services industry that was fuelled by a culture based on greed and pursuit of profit at any cost.

"Bonuses and other financial incentives formed a major component of many claims that were brought in the courts, whether successful or otherwise."

Economist Frances Coppola struggles to find a positive in mini-budget

Mr Kwarteng also used his speech in Parliament to reiterate government support for people and businesses to help them cope with high energy bills.

"People need to know that help is coming - and help is indeed coming," he said.

He said the energy plan would reduce inflation, lowering "wider cost of living pressures".

"Let no one doubt... this government is on the side of the British people," he said.