Shelagh Fogarty 1pm - 4pm

26 July 2023, 15:35 | Updated: 26 July 2023, 15:40

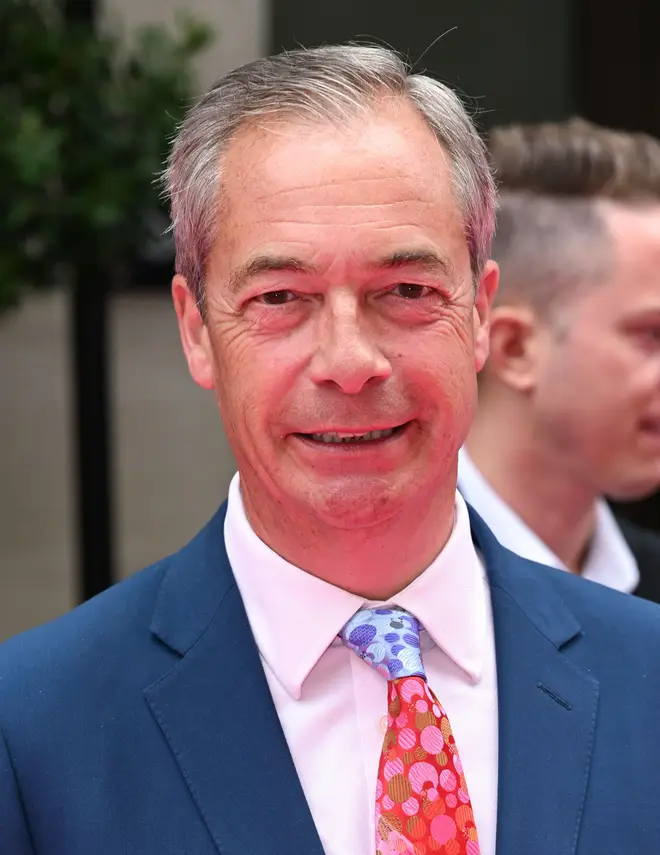

NatWest's share prices have plummeted by nearly four per cent after its CEO stepped down amid a row over Nigel Farage's bank account.

Around £850m is estimated to have been wiped off the bank's value after Dame Alison Rose, the CEO of the NatWest Group, quit.

Ms Rose admitted making "a serious error of judgment" by talking about politician Mr Farage's bank account at Coutts, which is part of the wider group.

In a statement released early on Wednesday morning, NatWest Group chairman Sir Howard Davies said: "The Board and Alison Rose have agreed, by mutual consent, that she will step down as CEO of the NatWest Group. It is a sad moment.

"She has dedicated all her working life so far to NatWest and will leave many colleagues who respect and admire her."

Read more: Government should 'act immediately' and 'ban banks closing accounts' over free speech issues

Pressure is now growing on chairman Sir Howard Davies to resign, with Farage calling for the entire NatWest board to resign.

In her own resignation statement, Dame Alison thanked her colleagues "for all that they have done", adding: "I remain immensely proud of the progress the bank has made in supporting people, families and business across the UK, and building the foundations for sustainable growth."

It came just hours after the bank's board backed the beleaguered CEO, while saying that she would be paid less this year in light of the leak.

The controversy came after Mr Farage presented a 40-page dossier, showing that his Coutts account had been closed partly due to his political views conflicting with the bank's values.

Mr Farage, the founder of the Brexit Party, was a key driving force behind the UK leaving the European Union, and has repeatedly called for lower immigration. These views put him at odds with much of the country, although he also has many supporters.

The evidence, which he got from the bank itself through a data request, contradicted a BBC News story that said Mr Farage's account was closed because he didn't meet the £1 million threshold to bank with Coutts.

The BBC and its business editor Simon Jack apologised, saying the reporting had been based on information from a "trusted and senior source" but "turned out to be incomplete and inaccurate".

Apologising earlier, Dame Alison said she thought the information was already in the public domain.

She said she had not revealed “any personal financial information” about Mr Farage but admitted: “I left Mr Jack with the impression that the decision to close Mr Farage’s accounts was solely a commercial one.

"Put simply, I was wrong to respond to any question raised by the BBC about this case. I want to extend my sincere apologies to Mr Farage for the personal hurt this has caused him."

Sir Howard said the "overall handling of the circumstances surrounding Mr Farage's accounts had been unsatisfactory, with serious consequences for the bank", before promising an independent review, which will be made public.

Columnist for The Telegraph, Simon Heffer calls for NatWest boss's resignation.

Sheldon Mills, Financial Conduct Authority (FCA) executive director for consumers and competition, said it had raised concerns about breaches of confidentiality by Coutts and its parent company NatWest.

He also emphasised the importance of a "well-resourced" independent review to investigate the matter "swiftly" and "fully", adding: "On the basis of the review and any steps taken by other authorities, such as the Financial Ombudsman Service or Information Commissioner, on relevant complaints, we will decide if any further action is necessary."

Several Conservative MPs, including Sir Jacob Rees Mogg, had already called on Dame Alison to go. Downing Street had also voiced "significant concerns" about the incident.

The government owns close to 39% of NatWest, after a bailout in the 2008 financial crisis. The government was the majority shareholder until March last year.