Ali Miraj 1pm - 4pm

27 March 2024, 10:54

The digital marketing firm reported a 7.8% drop in like-for-like revenues for 2023, with comparable underlying earnings plunging 36.6% to £93.7m.

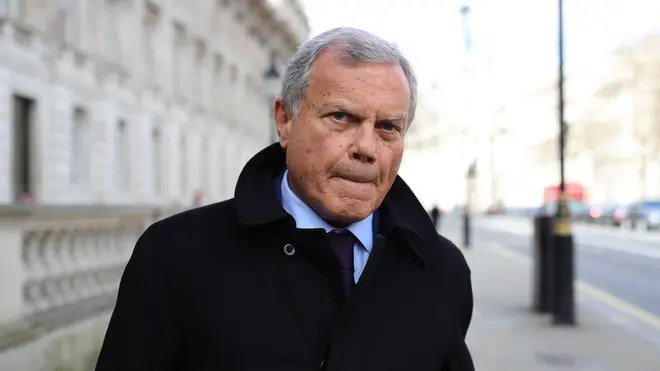

Sir Martin Sorrell’s digital marketing firm has revealed tumbling earnings and staff cuts after a “difficult year” and warned that results will remain under pressure over the year ahead.

S4 Capital reported a 7.8% drop in like-for-like revenues for 2023, with comparable underlying earnings plunging 36.6% to £93.7 million.

On a statutory basis, it remained in the red with pre-tax losses of £13.9 million, although this was narrowed from £159.7 million in 2022.

Shares in the firm tumbled 12% in Wednesday morning trading.

The group said it slashed its workforce by more than 13% to 7,707 to save costs in the face of a tough market and rising wage bills, and “continues to manage costs tightly, given the current uncertain market outlook”.

Executive chairman Sir Martin – who founded and led global advertising giant WPP before leaving in 2018 – said S4 Capital had suffered a “difficult 2023” as firms slashed their ad spend amid economic uncertainty and soaring costs.

The group warned that firms will “remain cautious” on their ad spend over 2024 “despite the possibility of interest rate reductions later in 2024”.

It said net revenues are expected to fall again over the year ahead, but that cost-cutting will help underlying earnings remain “broadly similar overall” to last year.

Sir Martin said: “After our first four strong net revenue growth years, we had a difficult 2023, reflecting challenging global macroeconomic conditions, fears of recession and high interest rates.

“This resulted in client caution to commit and extended sales cycles, particularly for larger projects, a difficult year for new business, as well as spend reductions from some regional and smaller client relationships.”

He added: “We took significant actions to reduce costs in the year and maintain a disciplined approach to operational efficiency.”

On the 2024 outlook, he said: “As usual, the year is likely to be weighted to the second half, aided by lower interest rates and the impact of our artificial intelligence initiatives.”

The company also announced a board shake-up, with the appointment of former EY partner Jean-Benoit Berty as new chief operating officer.