Rachel Johnson 7pm - 10pm

11 November 2021, 16:21

Companies which began trading after the furlough scheme was created, have claimed up to £26.6million from the government, an investigation has revealed.

An estimated 340 companies, registered to just five addresses, have allegedly claimed furlough despite being created on or after March 1 last year.

According to an investigation, three of the most used addresses are linked to specialist firms used to create new businesses on behalf of clients, The Times has said.

The furlough scheme was set up at the start of the pandemic and helped to pay an estimated 11.7 million workers' wages, costing the government around £70billion.

Employees unable to work due to the pandemic were able to claim a monthly limit of up to £2,500 providing a life line for those in industries such as hospitality and the arts sector.

Read more: Prince Charles speaks out on Queen's health in fresh update

Read more: MPs 'who got drunk' on official Remembrance Day trip criticised by Defence Secretary

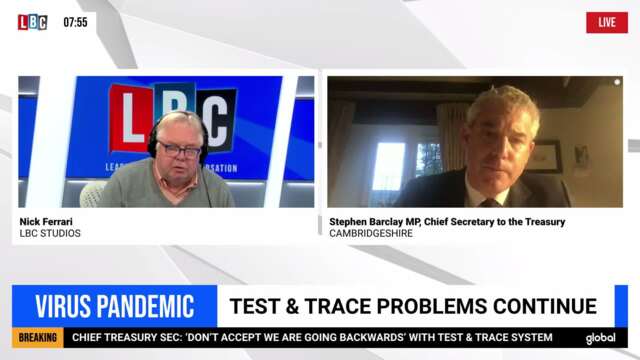

"£2bn in furlough fraud, how did that happen?"

The new investigation by The Times comes after HMRC revealed around £5.8billion, or nine per cent of pandemic funding, had been lost to fraudulent or mistaken claims throughout the pandemic including during 'Eat Out to Help Out'.

The government has now created a designated team within HMRC who have been ordered to recover £1billion in fraudulent or mistaken claims.

Read more: School refuses to serve food to pupils whose meal account is more than a penny in debt

Read more: No jabs no job: chaos as new care home vaccine policy comes into force

According to a spokesperson, work is already under way, with 23,000 ongoing investigations already launched.

HMRC said in their annual report that the fraud estimate was "in line" with original assumptions adding: "From the beginning it was clear the schemes would be targets for fraud and that customers would make mistakes."