Ian Payne 4am - 7am

3 November 2021, 19:30 | Updated: 3 November 2021, 19:54

Day four in Glasgow's Big Climate Campus and it was, in the words of Jessie J, all about the money, money, money.

With world leaders departed from Cop26, all eyes turned to their financial ministers, as the question of just how countries would pay for the high level pledges on reducing emissions, stopping deforestation and keeping 1.5C alive, came into sharp focus.

One answer was GFANZ - not another girl group discovered by Simon Cowell, but the Glasgow Finance Alliance on Net Zero (the UN loves an acronym as much as it loves to see delegates queuing and it turns out that Cop - which stands for Conference of the Parties - is the simplest of them all).

GFANZ brings together more than 450 firms from all parts of the financial industry, based in 45 countries - those involved, every company, bank, insurer and investor has signed up to adjusting their business models and developing credible plans for the shift to a low-carbon, climate resilient future.

Read more: Eustice defends chopping down trees for HS2 after COP26 deforestation deal

Read more: Jeff Bezos tells COP26 trip to space made him realise how 'fragile' planet is

They then have to implement those plans. And the theory is that private finance can help turn the billions committed through public channels into trillions for climate investment. $130trn in fact according to Rishi Sunak.

The Chancellor said GFANZ was part of ensuring the UK will be the first net zero aligned financial centre. So there will be new requirements for all UK financial institutions and listed companies to publish net zero transition plans that detail how they will adapt and decarbonise by 2050.

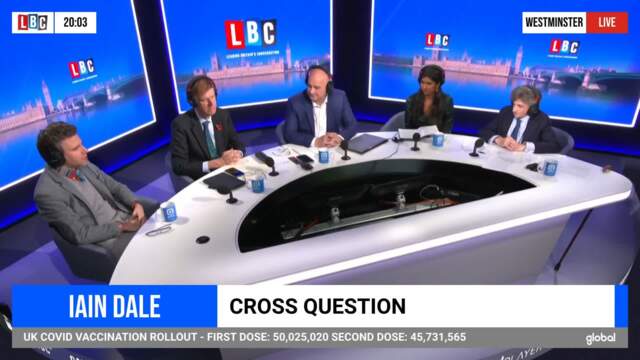

Lisa Nandy gives her verdict on Boris Johnson's COP26 performance

And to "guard against greenwashing", a science-based "gold standard" will be drawn up while there will also be "strong Government oversight" of the financial sector as a whole to ensure financial flows actually shift towards supporting net zero.

The fly in the ointment though is this scheme to get companies to net zero isn't mandatory - or at least not yet.

It will be up to firms and their shareholders to decide how businesses will adapt - the kind of statement to give climate activists the heebie-jeebies.

It also doesn't mean investments in carbon intensive activities are no longer allowed. So putting your cash in oil and gas is still a-ok it the market determines it is. Hopes seem to be pinned on investors using their influence and their votes to encourage more ambition or accelerated progress to net zero.

And what does it all mean for the man or woman in the street? Well this huge pool of cash should go towards making electric cars cheaper, making energy greener and cheaper, and ensuring the restoration of trees and other biodiversity - basically they hope that it will make "going green" easier and cheaper for everyone.

COP26 pointing in right direction despite Xi and Putin no-show

Meanwhile in a break-out room on the campus, a long term relationship suddenly hit the rocks. The anti-oil drilling Scottish Greens – now part of the Scottish Government – have had a parting of the ways with the anti-oil drilling Greenpeace, declaring the organisation which sailed its Rainbow Warrior ship up the Clyde yesterday just didn't understand Scotland anymore.

The row is over the potential new drilling for oil in the Cambo field in the North Sea. Greenpeace have accused Nicola Sturgeon of "hiding behind Boris Johnson" on the issue saying she cannot intervene as energy is reserved to Westminster, though she has asked for a "tougher appraisal" of the scheme.

When asked about it at Cop26 by LBC, Scottish Green MSP Ross Greer (who doesn't hold a government post) said that the London-based NGO didn't understand Scotland.

It obviously pained him given he had joined Greenpeace at 15 – the same age he joined the Scottish Greens. It's not me, it's you, he almost said.