Richard Spurr 1am - 4am

29 September 2022, 17:19 | Updated: 29 September 2022, 17:28

Kwasi Kwarteng has made a desperate plea for unity to Tory MPs after the financial turmoil that unfolded after his mini-budget.

The chancellor, who has dug his heels in over his big tax cutting plan, again insisted to colleagues that global markets were volatile thanks to the war in Ukraine, post-Covid issues and a "super strong" dollar.

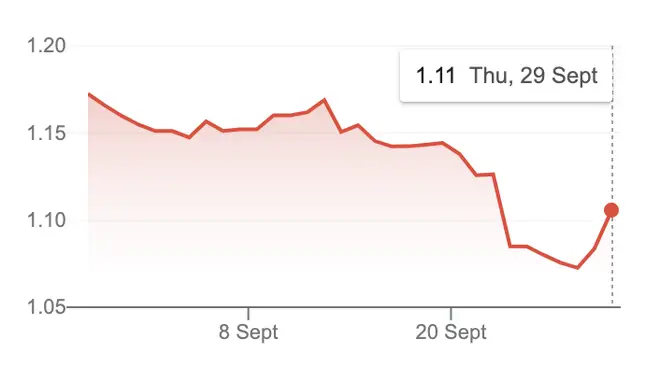

He and Liz Truss have both tried to calm matters with statements on Thursday but did little to lift fears generated by the new budget, which saw the pound tumble and the Bank of England move to prevent the risk of pension funds collapsing.

In a message to Tory MPs, leaked to Sky News, Mr Kwarteng – ahead of a potentially volatile Conservative Party conference at the weekend – said: "We are one team and need to remain focused.

"There is immense global market volatility – not just a UK issue – being driven by war, Covid hangover, and a super strong USD all other major currencies are wrestling with (see Japan this week; Euro down)."

However, those suggestions – trotted out by the Government repeatedly – were slapped down by the Bank of England's chief economist, Huw Pill, who said some of the repricing of financial assets "reflects broader global developments" including the post-pandemic problems but "there is undoubtedly a UK-specific component".

Mr Kwarteng, in his message, tells MPs raising taxes was not an option but he did "totally understand the need to be credible with markets", insisting "we will show" them the Government's plan is "sound, credible and will work to drive growth".

He added: "We are working at pace to align our spending policy to show the markets there is a clear plan."

He said "supply side reforms coming over next six weeks" would include changes to business regulations, financial services and childcare.

"We need your support to do this as the only people who win if we divide is the Labour Party… I am always available for a meeting."

Ms Truss and Mr Kwarteng's economic policy has been savaged by Labour, with Sir Keir Starmer saying the PM had "lost control" while his party repeatedly characterised the mini-budget as a gamble.

Some Conservatives have also grown wary about the mini-budget and market reaction.

Mr Kwarteng cut taxes, including through the abolition of the top rate, but spooked markets after criticism of Government spending with reduced revenues.

Read more: PM flounders as she struggles to defend financial turmoil in series of car crash radio interviews

As the pound fell against the dollar, the Bank of England had to step in to buy £65bn of Government bonds after the price of those bonds tumbled.

Pension funds tried to sell their bonds and assets at ever-lower prices, running the risk of being unable to pay their debts before the Bank intervened.

Ms Truss did little to allay any worries on Thursday morning, when she was mauled during interviews with local journalists, in which she repeatedly failed to guarantee Brits' pensions were going to be safe.