Ben Kentish 9pm - 1am

23 September 2022, 12:25

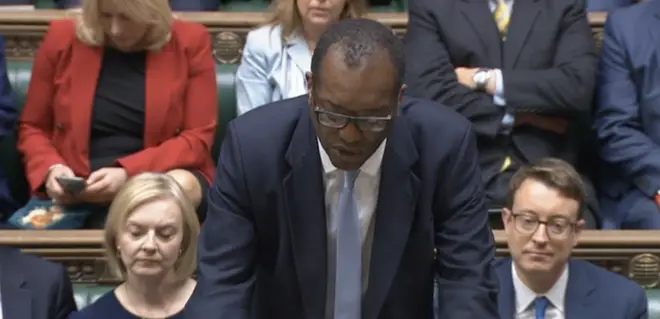

The planned rise in duty rates for alcohol will be cancelled, the chancellor Kwasi Kwarteng confirmed in today’s mini-budget.

In a boost to drinkers, the planned increases in the duty rate of beer, wine and spirits will be cut.

Chancellor Kwasi Kwarteng announced that the government would instead freeze alcohol duty rate in a measure worth “£600m annually”.

The treasury said cancelling the planned rise will save customers “7p on a pint of beer, 4p on a pint of cider, 38p on a bottle of wine, and £1.35 on a bottle of spirits.”

Back in February, the then chancellor Rishi Sunak introduced a measure to tax drinks based on their alcohol strength. Kwarteng’s announcement now cancels his predecessor’s economic plan.

The freeze in alcohol duty will come into effect in February 2023.

Read more: Higher rate of income tax axed for top earners and 1p cut for all amid biggest tax cuts since 1972

Chancellor Kwarteng said: “I have listened to industry concerns about the ongoing reforms.

“I will therefore introduce an 18-month transitional measure for wine duty. I will also extend draft relief to cover smaller kegs of 20 litres and above to help smaller breweries.

“At this difficult time, we are not going to let alcohol duty rates rise in line with RPI [inflation]. I can announce that the planned increases in the duty rates for beer, for cider, for wine, and for spirits will all be cancelled.”

The measure on alcohol duty was part of Kwarteng’s mini-budget aimed at tackling the cost-of-living crisis and boosting economic growth.

The basic rate in income tax has been cut down from 20p to 19p to the pound. The 45% top rate of tax for higher earners has also been abolished. This will not apply in Scotland.

The threshold before stamp duty is paid has been raised to £250,000, and £425,000 for first time buyers. This will only apply to England and Northern Ireland.

Other announcements include scraping the cap on bankers’ bonuses, intending to make London more attractive to global bankers.

The chancellor also introduced new ‘low-tax investment zones’ to target more deprived local areas. This aims to liberalise planning rules in specific areas of the UK and target local economic growth.

Labour’s shadow chancellor Rachel Reeves criticised the government’s announcement today.

Ms Reeves said: “This statement is an admission of 12 years of economic failure. And now, here we are – one last throw of the dice. Once last claim that these ministers will be different.”

Ms Reeves added that this was a “comprehensive demolition” of the government’s 12 years in power.