Nick Abbot 10pm - 1am

22 March 2023, 17:47 | Updated: 22 March 2023, 18:30

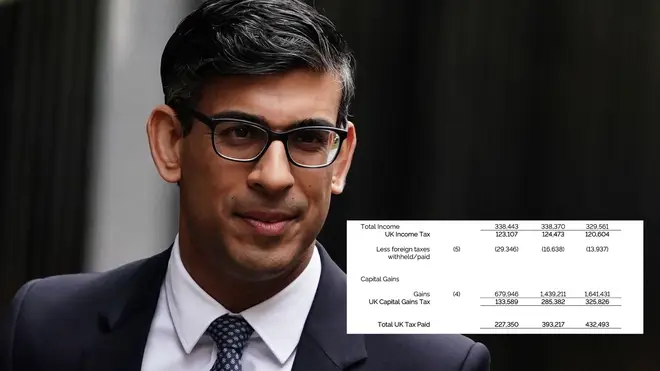

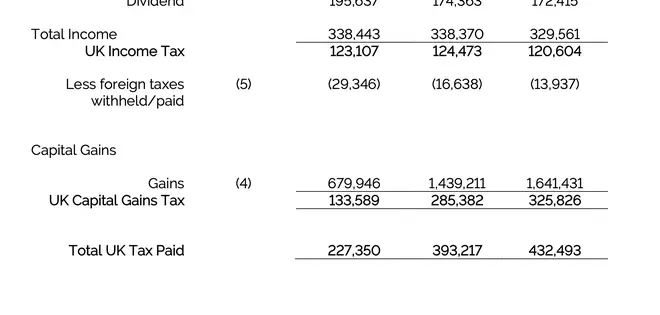

Prime Minister Rishi Sunak has published his personal UK tax returns covering the past four years, showing he paid £432,493 in tax in the 2021/22 financial year.

Most of the tax was paid on his capital gains earnings, which totalled to more than £1.6 million in that tax year.

Mr Sunak paid £325,826 in capital gains tax and £120,604 in UK income tax on an income of £329,561.

No10 published "a summary" of his UK taxable income, capital gains and tax paid as reported to HMRC, prepared by accountancy service Evelyn Partners.

Details of the return showed that he paid £393,217 in 2020/2021, and £227,350 in 2019/20.

The release of the document comes as Boris Johnson is being questioned the privileges committee over the Partygate scandal.

It is also on the same day that the Commons voted on Mr Sunak's new deal on post-Brexit trading arrangements for Northern Ireland.

Labour deputy leader Angela Rayner tweeted: "Wonder why he's chosen today?"

CEO of Open Democracy Peter Geoghegan breaks down Rishi Sunak's tax return

The PM first pledged to publish his tax returns during his initial campaign to become Tory leader last summer, in a bid to show transparency.

He repeatedly promised to do so in recent months, and faced continued pressure to release the documents when it emerged Tory former minister Nadhim Zahawi settled an estimated £4.7 million bill with HMRC while he was Chancellor.

Mr Sunak's family finances previously faced scrutiny while he was Chancellor too, when the "non-dom" status of his wife Akshata Murty was revealed.

Following the controversy, Ms Murty, the fashion designer billionaire's daughter who married Mr Sunak in 2009, declared that she would pay UK taxes on all her worldwide income.

Speaking to LBC's Ben Kentish, openDemocracy CEO Peter Geoghegan said: "The headlines lots of people will talk about is he's paid over £1 million in tax in three years, which is true, but if you dig down beneath it, you'll also see that because so much of Rishi Sunak's income comes from investment capital, he's effectively paid a marital tax rate of 22% on an income of just under £2 million in the last year.

"Someone like Rishi Sunak, who has a lot of money, actually doesn't pay a very high rate of tax.

"The amount of tax he's paid is a lot but the rate is a lot less than the likes of you and me who are on PAYE contracts."

He added: "For someone like Rishi Sunak, the £150,000 he gets as Prime Minister only represents about 10% of his income last year.

"For him, he's got lots of income from other things and because those other things are capital and investments, they're taxed way lower."

"He's paid a lot of tax because he's made a lot of money, he's very wealthy.

"This is somebody, who from capital alone has made over about £3.5million in the last three years... he hasn't gone out and actually had to earn that income, that's income generated from investments he has."