Clive Bull 1am - 4am

16 September 2019, 23:42

Manhattan's district attorney ordered the president to submit his personal and corporate tax returns from 2011 onwards as investigators examine hush money allegedly paid to Stormy Daniels.

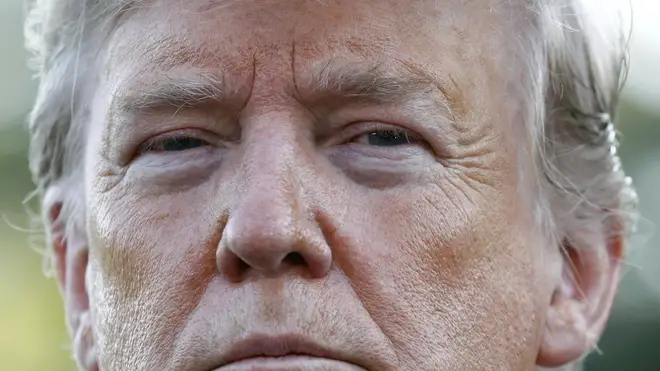

New York County District Attorney Cyrus Vance sent a subpoena to Donald Trump's accounting firm, Mazars USA, to look into his personal tax returns and those of the Trump Organisation.

Mr Trump said he would publicise his tax returns during the 2016 presidential campaign but is yet to disclose them.

The order was issued last month by Mr Vance's office shortly after opening a criminal investigation into hush-money payments made by the president and his family business.

The money was paid by Mr Trump's personal lawyer at the time, Michael Cohen, to the former porn actress Stormy Daniels in the run-up to the 2016 election after she claimed to have had an affair with the president.

Mr Trump reimbursed Mr Cohen for the payment and has always denied the affair.

However Mr Trump's former personal lawyer last year pleaded guilty to breaking federal campaign finance laws and is currently serving a three-year prison sentence.

Federal prosecutors probed the president's 2016 campaign payments to two women who claimed to have affairs with Mr Trump for months, including Ms Daniels and model Karen McDougal.

However, the president argued that the payments were a personal matter, rather than a campaign matter.

Those responsible for imprisoning Mr Cohen said their investigation had ended, however Mr Vance is looking to see whether state laws had also been broken.

A report in the New York Times said that Mr Vance's inquiry involves an examination of whether anyone at the Trump Organisation falsified business records by falsely listing the reimbursements to Cohen as a legal expense.

Falsifying business records can be a crime under New York state law.

However it only becomes a felony if prosecutors can prove that the false filing was made to commit or conceal another crime, such as tax violations or bank fraud.

Mazars USA confirmed in a statement that it "will respect the legal process and fully comply with its legal obligations."

The firm said it believes strongly in ethical and professional rules and regulations governing the accounting industry and does not comment on work it does for clients.

It remains unclear whether the subpoena is a sign that Mr Vance's office had expanded its investigation beyond actions taken during the 2016 campaign as sources close to the district attorney refused to comment.

A lawyer for the Trump Organisation, Marc Mukasey, said he is "evaluating the situation and will respond as appropriate."