Clive Bull 1am - 4am

23 March 2023, 12:06 | Updated: 23 March 2023, 13:01

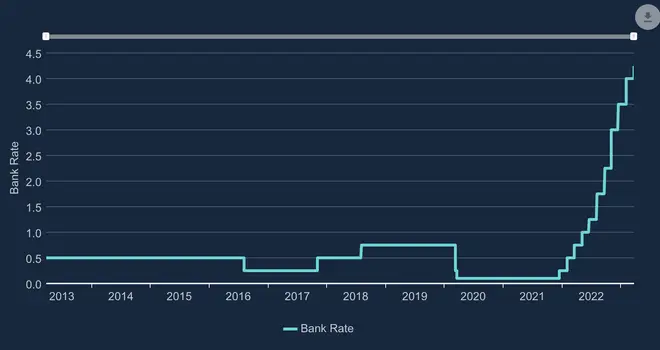

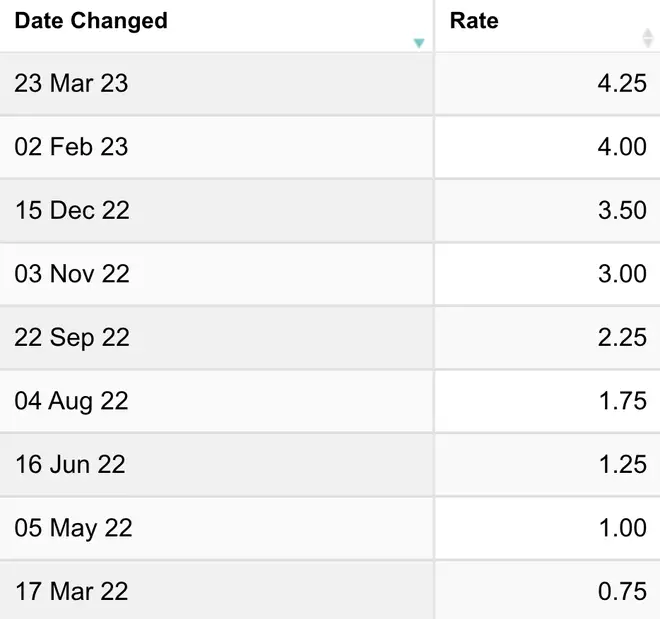

Interest rates have been increased to 4.25% from 4% by the Bank of England after a surprise leap in inflation - but it said it no longer expects the UK to enter a recession.

The increase reflects Bank's desire to reduce inflation, which rose unexpectedly in February from 10.1 per cent to 10.4 per cent, the Office for National Statistics revealed on Wednesday.

Inflation remains down from a 41-year high of 11.1% in October and is still expected to fall "significantly" by the end of the year, according to economic forecasts.

The Bank also said it expects the UK economy to grow slightly between April and June, revising a previous forecast that gross domestic product (GDP) would drop by 0.4%.

Read More: Inflation unexpectedly leaps to 10.4% after food prices rise to highest level in 45 years

"While subdued overall, activity was holding up better than contacts had previously expected, particularly in the consumer services sector," the Bank said.

The Government's decision to cancel a planned £500 rise in energy bills at the start of April will also help households, the Bank added.

"Real household disposable income could remain broadly flat in the near term, rather than falling significantly," the Bank said.

When interest rates are increased, around 1.4 million people on tracker and variable rate mortgages see an increase in monthly payments.

Those on standard tracker mortgage deals will pay around £24 a month, while those on variable rate mortgages will see an increase of around £15 a month.

Meanwhile, the pound has moved higher after the Bank of England increased interest rates.

Sterling was already around 0.3% higher against the dollar before the announcement, but made further gains to sit 0.5% at 1.232 after the increase was confirmed.

Though it is the 11th rise in a row and the highest interest rates have been in 14 years, the Bank may have signalled a peak in interest rates after rising it by 0.25 per cent, rather than 0.5 per cent, as we have seen in recent months.

The Bank also remained calm about a surprise jump in inflation, saying it is still likely to fall "significantly" in the third quarter even further than its economists had previously forecast, thanks to the energy bill support.

Read More: Hunt running a ‘high-tax, high-spend, low-growth, quasi-socialist economy’ – MP

Reacting to the increase in inflation, Chancellor Jeremy Hunt said "falling inflation isn't inevitable" and that the government would stick to its plan of halving it this year.

"We recognise just how tough things are for families across the country, so as we work towards getting inflation under control we will help families with cost-of-living support worth £3,300 on average per household this year," Mr Hunt said.

But Labour's shadow chancellor Rachel Reeves blamed the Government for the rise in prices, saying "nothing is working better than it did 13 years ago.

Ms Reeves said: "The reality is that under this Tory Government, families are feeling worse off and nothing is working better than it did 13 years ago."