Ben Kentish 7am - 10am

14 November 2022, 06:24 | Updated: 14 November 2022, 10:12

Energy bills are set to rise by £900 for millions of people in the UK next April, with government support schemes set to end - and skyrocketing council tax could add to the pain for households.

The government will say on Thursday that this winter's £400 handout to help with growing energy bills will not be repeated next year, according to the Mail Online, meaning households will have to pay £75 extra per month on average.

The £3,000 price cap is £500 higher than the limit promised by former PM Liz Truss, and almost three times above the level in April 2020.

Meanwhile councils are also set to be given the power to raise their own tax rates, in a bid to plug gaps in funding for local services.

The current policy is for local authorities to have to hold a referendum, if they want to raise council tax by more than 2.99%.

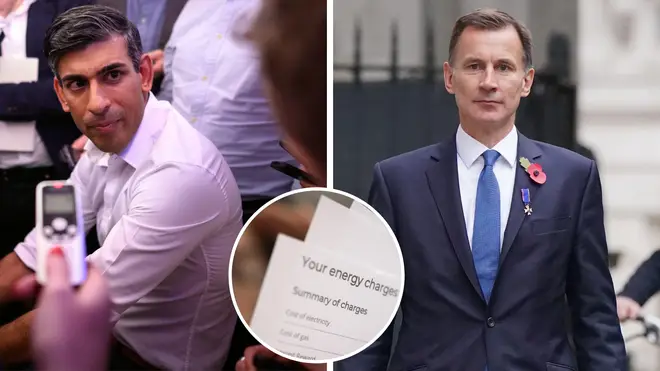

Chancellor Jeremy Hunt is expected to unveil a range of tax rises and service cuts in his Autumn Statement on Thursday. He has warned everyone will need to pay "a bit more tax" to stabilise the economy.

Prime Minister Rishi Sunak said measures to be revealed on Thursday will "put our public finances on a sustainable trajectory.”

Read more: 'Rogue state' Russia won't hold Britain hostage, Sunak vows at G20

Read more: Elon Musk sacks 80% of Twitter staff as company descends into chaos

This caller vents to David Lammy after previous caller says 'ordinary people should pay more taxes'

The statement is expected to include painful public spending cuts and tax hikes to plug a black hole in the nation's finances.

Mr Hunt earlier said "sacrifices" were required across the board to get the economy back on track.

But the planned tax rises have drawn criticism from some quarters of the Tory party, with former levelling up secretary Simon Clarke calling for the books to be balanced through spending cuts instead.

Ex-chancellor Kwasi Kwarteng, whose disastrous mini-budget was estimated by economists to have cost the country as much as £30 billion, said growth would not stem from "putting up our taxes".

Speaking to reporters on the plane to Indonesia for the G20 summit, Mr Sunak said financial conditions in the UK had "clearly" steadied.

"But they have stabilised because people expect the Government to take the decisions that will put our public finances on a sustainable trajectory, and it's the Government's job to deliver on that," he said. "And that's what the Chancellor will do."

The Prime Minister said he was "cognisant" of the dire economic situation the country is facing, after gross domestic product - the measure of national income known as GDP - contracted by 0.2% between July and September, potentially marking the start of a recession.

He stressed the importance of "delivering on the expectations of international markets" to "make sure that our fiscal position is on a more sustainable trajectory".

Asked whether the budget would spell years of pain for the public, Mr Sunak said the plan is to "lay the foundations" for growth so taxes can be cut "over time".

"The Chancellor has also said that part of our job is not just to bring stability back to the system, which we will do, but it's also to lay the foundations for the economy to recover and grow," he said.

"That's how we're going to be able to cut people's taxes over time and support public services. And you'll hear that side of the equation from the Chancellor as well."

Mr Sunak will return to the UK from the gathering of the leaders of major economies in Bali just in time for the budget on Thursday.

At the summit he aims to urge leaders to "step up to fix the weaknesses in the international economic system" and persuade them he will restore stability to the economy at home.

Mr Hunt has said "people with the broadest shoulders will bear the heaviest burden" as he is understood to be weighing up a cut to the threshold at which the highest earners start paying the top rate of tax.

The Resolution Foundation think tank's economists estimate that Liz Truss and Mr Kwarteng blew £20 billion on unfunded cuts to national insurance and stamp duty, with a further £10 billion lost to higher interest rates and Government borrowing costs, The Observer reported.

At the G20 summit, the Prime Minister evaded questions about whether that figure was correct and whether he would use the UK's recent experience as a lesson of how things could go wrong.

He said: "I think I said on the steps of Downing Street that mistakes were made and part of the reason I became Prime Minister was to fix that."

He pointed to global economic challenges such as soaring inflation after the Covid pandemic and Russia's invasion of Ukraine.

"Those are shared challenges and what I'll be talking about at the G20 with other leaders is what everyone is doing in their own countries and internationally to ensure resilience and stability in the financial system."