Paul Brand 10am - 12pm

15 March 2023, 18:58 | Updated: 15 March 2023, 19:12

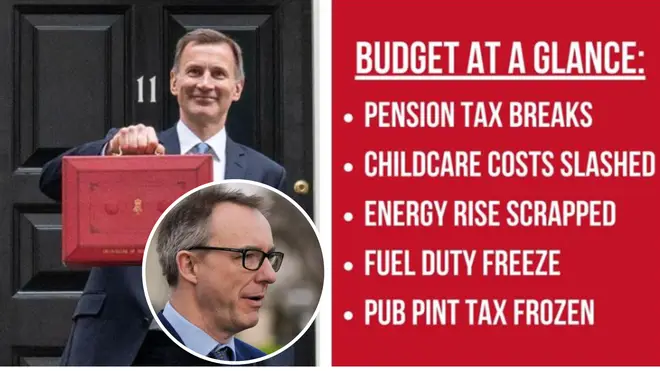

Incomes are set to fall dramatically for the average British household following Jeremy Hunt's Budget announcement, a top economist has warned on LBC.

Speaking on Tonight with Andrew Marr, Paul Johnson, director of the Institute for Fiscal Studies, said that the Office for Budget Responsibility (OBR), a public body that independently analyses government spending, was expecting a record drop in incomes of nearly 6% over a two-year period.

The fall will largely be down to two factors: inflation, which is still rising ahead of earnings, although it is set to come down markedly this year; and high taxes.

Mr Johnson said: "The OBR thinks we’ll see a 5% fall in our incomes - the biggest two-year fall on record. Now that’s partly, of course, to do with inflation and the fact that earnings aren’t keeping up with inflation, but it’s also to do with [the fact that] taxes are rising.

IFS chief @PJTheEconomist warns Household incomes are ‘shrinking'

"There’s actually a very big tax rise coming in April – all of our income tax thresholds and allowances are being frozen – that’s effectively a £500 tax increase for most basic rate taxpayers, and a £1,000 tax increase for most higher rate taxpayers."

Simon Clarke, a Conservative MP and former chief secretary to the Treasury, told Andrew earlier in the programme that the tax increases were not "sustainable".

He said: "The country has been through hell over the last few years, through the pandemic, through the consequences of what's happened in Ukraine. No one and no government I think could be expected to have delivered a low tax Elysium in light of that.

"But we do have to be clear, this isn't a sustainable position.

"It isn't good for growth. And it is something which as a government, we should be determined to address. And I think that does mean making some different decisions."

Tory MP: ‘I think a B+ would be a very fair assessment of where the government is today.'

It comes after The OBR said real household disposable income (RHDI) per person was expected to fall by a cumulative 5.7 per cent over the two financial years 2022-23 and 2023-24.

"While this is 1.4 percentage points less than forecast in November, it would still be the largest two-year fall since records began in 1956-57," the OBR said.

"The fall in RHDI per person mainly reflects the rise in the price of energy and other tradeable goods of which the UK is a net importer, resulting in inflation being above nominal wage growth.

"This means that real living standards are still 0.4% lower than their pre-pandemic levels... But they are 0.6% higher than we forecast in November thanks to lower market expectations for medium-term gas prices and the upward revision to potential output."

Read more: Commentary: Check the fine print and Hunt’s Budget 'looks a bit less impressive'

Mr Johnson said it was "very striking" that the Chancellor had not addressed public sector pay, despite waves of strikes among several public sector unions in recent months - but that he had extended the fuel duty cut.

The IFS chief told LBC: "The chancellor didn’t talk at all about public sector pay, and we’re seeing strikes in the public sector because earnings there are rising not only more slowly than prices, they’re also rising more slowly than earnings in the private sector.

"And the consequence is that senior teachers and nurses are 10-15% down on their earnings ten years or so ago. And while earnings in the private sector haven’t done brilliantly, they certainly haven’t gone down in that kind of way.

"And it really was very striking that the Chancellor found money for, for example, motorists – but he didn’t find any money in the budget for nurses or teachers."