Oli Dugmore 4am - 7am

3 October 2022, 08:15 | Updated: 3 October 2022, 10:25

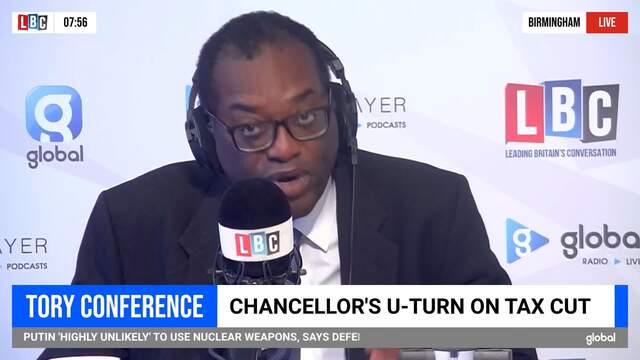

Kwasi Kwarteng failed to rule out further U-turns after reversing his plan to abolish the top rate of income tax.

The Chancellor was forced to issue a statement acknowledging it was not a good look to cut the 45p tax rate for people earning £150,000 or more, after a backlash from within his own party.

Speaking on LBC's Nick Ferrari at Breakfast, just after the statement was made, the Chancellor was asked three times if he planned any other U-turns.

Nick Ferrari to Kwasi Kwarteng: 'No more U-turns?'

"I've said what I've said about the 45p rate and I'm totally focused on delivering the growth plan, on delivering the energy intervention or making sure that the 1p reduction in the basic rate continues.

"And we're totally focused on the growth plan."

Asked the third time if there would be more U-turns, he repeated: "We're totally focused on the growth plan."

"Why wont you say no more U-turns?" Nick asked.

"We're totally focused on the growth plan," he said again, referring to the tax cutting mini-budget he announced that he and Liz Truss have insisted will allow the economy to expand.

Mr Kwarteng also went on to say that he had U-turned "in a spirit of contrition and humility I have said 'actually this doesn't make sense, we won't go ahead with the abolition of the rate'," adding that there are "lots of reversals" in politics, including "Marcus Rashford's campaign".

Along with other reforms like abolishing the cap on banker's bonuses, Mr Kwarteng had hoped to scrap the highest income tax bracket in a bit to stimulate growth.

But the market reaction was terrible, with the pound tumbling against the dollar and the Bank of England having to buy up £65bn of Government bonds to ensure some pension funds would not be at risk of collapsing.

After the Government argued there were global factors at play in the economic turbulence, Ms Truss finally admitted the communication could have been better ahead of the mini-budget.

She also shifted blame to the Chancellor for adding the idea to cut the top rate of income tax.

The issue overshadowed the opening of the Tory conference in Birmingham, with Michael Gove criticising the tax rate's planned abolition before Mr Kwarteng announced his U-turn.

Mr Kwarteng said in a statement on Monday: "From supporting British businesses to lowering the tax burden for the lowest paid, our growth plan sets out a new approach for a prosperous economy," he said in a statement on Monday morning.

"However, it is clear that the abolition of the 45p tax rate has become a distraction from our overriding mission to tackle the challenges facing our country.

"As a result, I am announcing we are not proceeding with the abolition of the 45p tax rate.

"We get it, and we have listened. This will allow us to focus on delivering major parts of our growth package."

That came despite him being due to insisting his mini-budget was the "right thing to do" and the Tories must "stay the course".

The pound bounced back to levels seen before the Government's controversial mini-budget after the U-turn.

Sterling went to 1.13 US dollars at one stage overnight, recovering ground lost in the turmoil that followed the mini-budget announcement, but it pared back some of the gains in early morning trading to stand at 1.12.