Tom Swarbrick 4pm - 7pm

5 January 2024, 15:01

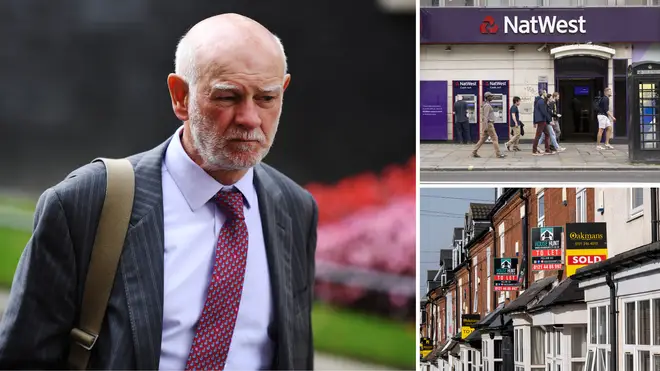

NatWest's chief has said he did not intend to "underplay the serious challenges" prospective homeowners face after claiming it is "not that difficult" to buy a home.

Sir Howard Davies said this morning that he believes it is not currently "that difficult" for people to get on the property ladder.

Though he said it is necessary to save more money these days, Sir Howard said saving had always been necessary to buy a house.

His comments prompted a significant backlash among experts and prospective homebuyers, causing Sir Howard to row back on his remarks.

Sir Howard Davies said this afternoon his claim was meant to reflect easier mortgage access.

"Given recent rate movements by lenders there are some early green shoots in mortgage pricing and while funding remains strong, my comment was meant to reflect that in this context access to mortgages is less difficult than it has been," the NatWest Group Chairman said.

"I fully realise it did not come across in that way for listeners and as I said on the programme, I do recognise how difficult it is for people buying a home and I did not intend to underplay the serious challenges they face.

"People have to save much more than they did in the past and that is tough for first time buyers. The role for banks in today's environment is to lend responsibly and support customers to build a savings habit and move towards home ownership," he added.

Read More: Nigel Farage to launch legal battle with NatWest over debanking saga

Read More: Full list of 19 NatWest and RBS branches due to close

Reacting to Sir Howard's comments on the Today programme this morning, mortgage specialist at Lifetime Wealth Management said it was a "ludicrous" claim to make".

"The cost of living is the highest it has been, rents are increasing year on year and house prices, interest rates and the lack of first-time buyer schemes are all adding to the difficulty in getting on the property ladder.

"Sir Howard Davies is totally out of touch with reality," she said.

Data produced last year shows that only around ten percent of income earners can afford an average house with less than five years of income in England.

Meanwhile, the average age of a first-time buyer has risen to 32.

Sir Howard, who is set to stand down from his role in April, earns £750,000 a year.