Paul Brand 10am - 12pm

9 December 2022, 09:38

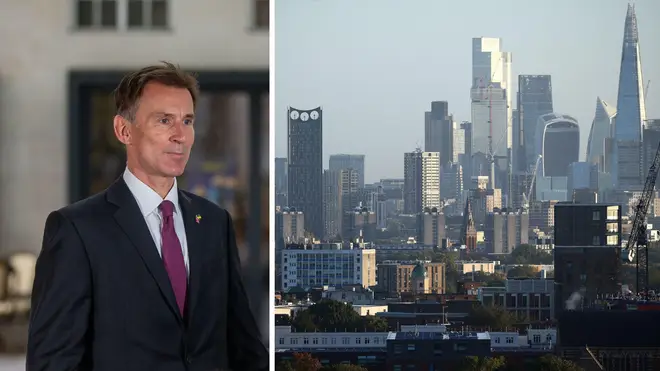

Jeremy Hunt has unveiled a post-Brexit 'big bang' for financial sector in a bid to boost growth.

In what has been described as the biggest overhaul of financial regulations for more than 30 years, the government says the package of more than 30 reforms will "cut red tape" and "turbocharge growth".

On a visit to Scotland, the Chancellor declared that EU red tape will be slashed and credit crunch-era rules loosened to unlock £100billion of investment in the UK economy.

The 'Edinburgh reforms' are designed to bolster the capital's status as the pre-eminent financial centre in Europe - which has been dealt a blow over recent years.

The package has echoes of Margaret Thatcher's 'big bang' deregulation during the 1980s and will loosen banking rules introduced after the 2008 financial crisis, which saw some UK banks face potential collapse.

The government has already announced it will scrap a cap on bankers' bonuses and allow insurance companies to invest in long-term assets such as housing and windfarms to boost investment and help its levelling up agenda.

There is a commitment to make 'substantial legislative progress' on repealing and replacing the Solvency II directive next year, which the Treasury believes will free up more than £100billion of private investment.

Mr Hunt also promised to reform the UK prospectus regime to support stock market listings and capital raises, reforming rules on real estate investment trusts and reviewing provisions on investment research in the UK.

Read More: Royal Mail Christmas strikes begin and letters pile up as 115,000 workers walk out in row over pay

Read More: Killer and rapist would leave jail without signing sex offenders' register due to legal loophole

Mr Hunt also promised to reform the UK prospectus regime to support stock market listings and capital raises, reforming rules on real estate investment trusts and reviewing provisions on investment research in the UK.

Mr Hunt said: "We are committed to securing the UK's status as one of the most open, dynamic and competitive financial services hubs in the world.

"The Edinburgh Reforms seize on our Brexit freedoms to deliver an agile and home-grown regulatory regime that works in the interest of British people and our businesses.

"And we will go further – delivering reform of burdensome EU laws that choke off growth in other industries such as digital technology and life sciences."