Tom Swarbrick 4pm - 7pm

10 April 2024, 07:17

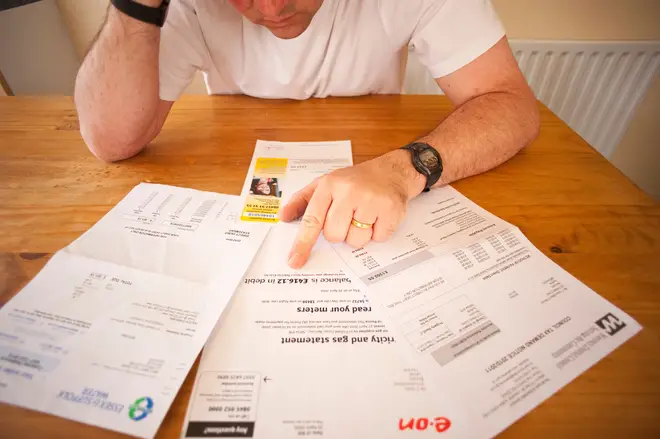

The number of people who missed bill payments in January came down significantly from a year earlier, researchers have found.

More than seven million people were struggling with bills in the first month of the year, according to the Financial Conduct Authority.

That was down considerably from the 10.9 million people in a similar condition in January 2023.

But it was still up significantly on the 5.8 million who found it hard to pay their bills in early 2020, before the pandemic, the war in Ukraine, and skyrocketing inflation.

People struggling were most likely to be renters, single adults with children, adults from ethnic minorities and people in the north-east of England.

Read more: Divorce rates plummet to lowest level in 50 years ‘due to cost-of-living crisis’

Caller and James discuss Mel Stride's 'fundamental lack of empathy'

Just over a quarter of renters had missed a bill or a credit payment in January 2024.

But only 6% of tenants missed a rent payment, suggesting they prioritised that over other bills.

The report quoted one unemployed female renter saying: "It's truly awful. Most days I'm stuck deciding if I'm going to starve or be cold. We worry about what bill is coming around the corner... We survive because of the kindness of others - charity and family."

Financial companies have to help customers manage payments if they are struggling, but 40% of people had not spoken to lenders about this.

Lewis Goodall: 'It's one of the biggest fantasies of British politics...what an absolute joke.'

Some 2.7 million people had spoken to debt advisers and support charities, with nearly half saying they were in a better position for it.

Steve Vaid, chief executive of the Money Advice Trust - the charity that runs National Debtline, said: "No-one has to struggle alone."

He added: "The FCA's decision to make permanent its pandemic-era protections for people in debt is a welcome step - and the regulator has set clear expectations for firms on the crucial role that debt advice plays."

Sheldon Mills, the FCA's executive director of consumers and competition, said this was "encouraging".

"If you're worried about keeping up with payments, reach out to your lender straight away," he said.

"They have a range of support options and will work with you to agree the best one for you. You can also find free debt advice through MoneyHelper."