Henry Riley 4am - 7am

6 March 2024, 13:38 | Updated: 7 March 2024, 01:01

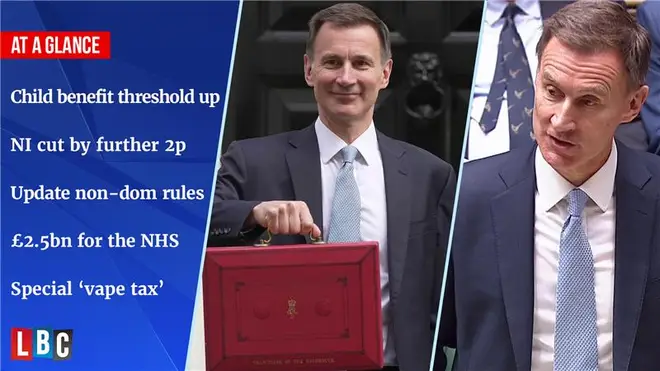

Jeremy Hunt delivered the government's Spring Budget on Wednesday afternoon, where he promised tax cuts to national insurance and alcohol and fuel duty freezes.

Hoping to turn around the Conservative Party's general election hopes as voters head to the polls later this year, the Chancellor announced modest tax cuts, further levelling up funding and additional ISA initiatives.

Mr Hunt announced a variety of fiscal measures that will be rolled out over the next few years - many of which will require the Conservatives to win the next scheduled general election and extend their 14 years in power.

Mr Hunt has announced a 2p cut to National Insurance contributions for employees that will come into effect from April 6. The chancellor has been under pressure, particularly from Tory MPs, to cut taxes currently at a historic high.

National Insurance contributions are paid by employees and the self-employed on their earnings, as well as employers. The amount paid depends on an individual's salary.

A further 2p cut is worth around £450 a year for someone on a full-time salary of £35,000.

Cutting National Insurance is cheaper than cutting income tax. Some Conservative MPs, however, fear it is less well understood by many voters and so is less beneficial politically.

"It won't be able to fill the big black hole that is public finances" says Natasha Clark

Read More: Jeremy Hunt freezes duty on fuel and alcohol as he unveils pre-election 'tax-cutting' Budget

Read More: LIVE: Jeremy Hunt hails ‘tax-cutting’ Budget with 2p National Insurance cut set to save Brits £900

The Chancellor said the government would abolish the non-domiciled tax status for wealthy foreign residents living in the UK.

He has effectively assumed the policy that Labour previously said they would install once they come into power.

Mr Hunt said the change would make the system "fairer and competitive". However, he said it would be replaced with a "modern residency system".

The child benefit threshold has also been raised, the chancellor announced, providing more help to parents.

The high-income charge threshold will increase from £50,000 to £60,000 and the taper will extend up to £80,00.

He said the new rule will apply to collective household income rather than individually. Mr Hunt said he aims to introduce this by April 2026.

The chancellor said he intends to reform the ISA system to encourage more people to invest in UK assets.

"After a consultation on its implementation, I will introduce a brand new British Isa which will allow an additional £5,000 annual investment for investments in UK equity with all the tax advantages of other ISAs.

"This will be on top of the existing ISA allowances and ensure that British savers can benefit from the growth of the most promising UK businesses as well as supporting them with the capital to help them expand."

This is intended to encourage more people and funds to invest in UK stocks and shares.

Currently, only around four per cent of pension funds invest in British assets.

Continuing his Budget, the chancellor said there would be additional £2.5 billion funding for the NHS over the coming year.

Mr Hunt said: "On top of funding this longer-term transformation, we will also help the NHS meet pressures in the coming year with an additional £2.5 billion.

"This will allow the NHS to continue its focus on reducing waiting times and brings the total increase in NHS funding since the start of the parliament to 13% in real terms."

For the 14th year running, fuel duty will be frozen - amounting to around a £5 billion tax break for motorists.

Mr Hunt said he has "decided to maintain the 5p cut and freeze fuel duty for a further 12 months. This will save the average car driver £50 next year and bring total savings since the 5p cut was introduced to around £250."

The chancellor said alcohol duties will also remain frozen until February 2025, with the aim of "backing the great British pub".

"Today I have decided to extend the alcohol duty freeze until February 2025. This benefits 38,000 pubs all across the UK - and on top of the £13,000 saving a typical pub will get from the 75% business rates discount I announced in the autumn.

Mr Hunt added: "Taken together with the alcohol duty freeze, this decision also reduces headline inflation by 0.2 percentage points in 2024-25 allowing us to make faster progress towards the Bank of England's 2% target."

The Government will also introduce a new tax on vapes in a bid to discourage non-smokers from taking up the habit.

Mr Hunt told the Commons he was confirming "the introduction of an excise duty on vaping products from October 2026 and publishing a consultation on its design".

However, he said that because vapes "play a positive role" in helping smokers quit, there will also be a one-off increase in tobacco duty to ensure vaping remains cheaper than smoking.

Vaping products are currently subject to VAT at 20 per cent but, unlike tobacco, they are not also subject to excise duty. The Government has already published its plans to ban disposable vapes and will bring in new powers to restrict vape flavours and packaging.