Tom Swarbrick 4pm - 7pm

17 April 2024, 07:05 | Updated: 17 April 2024, 07:40

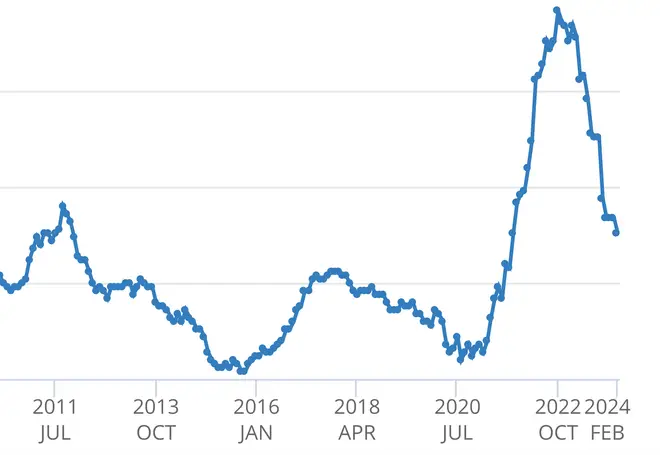

Inflation has fallen to 3.2%, a two-and-a-half year low, putting pressure on the Bank of England to cut interest rates.

It marks another fall in inflation after it fell to 3.4% in February from 4% in January. It also means inflation is significantly down from a peak of 11.1% in October 2022.

According to the ONS, falling food prices were a major factor in this month's inflation fall.

However, inflation sitting at 3.2% means it is still above the Bank of England's target of 2%.

Another fall in inflation will put pressure on the Bank of England to cut interest rates, which currently sit at 5.25%.

Jeremy Hunt said the fall shows that the "plan is working".

"This welcome news comes on top of our cuts to national insurance, which save the average worker £900 a year, so people should start to feel the difference as well as see it in their pay cheques," the Chancellor said.

In response, Labour's shadow chancellor Rachel Reeves criticised the Conservatives for claiming Brits have "never had it so good".

"Prices are still high in the shops, monthly mortgage bills are going up and inflation is still higher than the Bank of England's target," she said.

"At the same time Rishi Sunak risks crashing the economy again with his Liz Truss-backed £46 billion unfunded tax plan to abolish national insurance.

"The truth is Rishi Sunak is too weak to fix the economy his party broke and too out of touch to deliver for working people. It's time for change. Only Labour has a long-term plan to grow our economy, cut people's bills and make working people better off."

Grant Fitzner, chief economist at the ONS, said: "Inflation eased slightly in March to its lowest annual rate for two and a half years.

"Once again, food prices were the main reason for the fall, with prices rising by less than we saw a year ago.

"Similarly to last month, we saw a partial offset from rising fuel prices."