Paul Brand 10am - 12pm

14 September 2020, 08:31 | Updated: 9 October 2020, 15:27

Over the past few weeks on LBC we've been exposing the latest development in the cladding scandal, which has left up to 3 million of you living in 'worthless' flats.

Many are people who can't sell their homes without what's known as EWS1 "External Wall" form, the rest are people whose buildings have failed that form due to dangerous cladding, and now find themselves living in expensive fire-traps.

The latest shocking development, however, is that some of these buildings are so unsafe, they cannot get fire insurance.

Leanne bought her first home, a flat in Albion Works in Manchester three years ago.

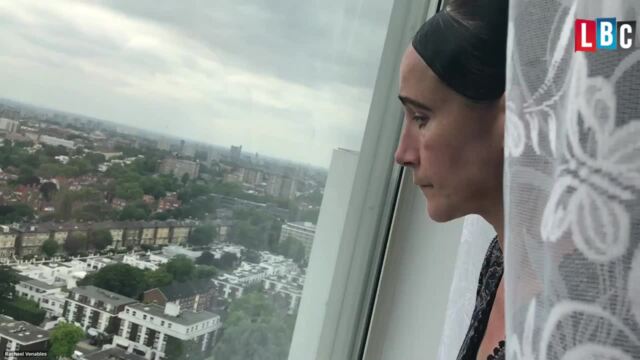

Cladding Tower Block Resident Left "Sick With Fear"

Unfortunately for her, and her roughly 100 neighbours, the block has a slew of fire safety problems: ''The wooden rendering on the ends of the building need completely stripping back.

''We have 6 inches of polystyrene insulation around the entire building that is uncompliant, which will mean having all the render taking off the building to take that out.

''We're also aware that our balconies are uncompliant in terms of the wooden structure that's around them, so all of the balconies need completely removing.''

They've already had to pay thousands of pounds per flat for fire wardens and a new alarm system while they wait for all these problems to be fixed.

LBC reporter inundated with people in "unsellable" flats over cladding

But, Leanne says, in an email on the 4th September the residents were told that their building is so dangerous, they cannot get fire insurance.

''Previously to that for a couple of weeks it was completely uninsured for anything.

''So me and my neighbours are absolutely terrified for what this means for us.

''But we're very much aware that if anything were to happen to our building, we would still be expected to pay mortgages, so to go on as if life was normal, but with no property.''

Martin Boyd is Chair of the charity, Leasehold Knowledge Partnership.

He knows of “eight or nine” other buildings in a similar position: ''If the insurers have got that nervous about the building, then there has to be the question, should people be living in it?''

He says that without full insurance, these leaseholder's mortgage agreements will be ‘voided,’ but doesn’t think it's in the banks' interests to foreclose - as flats with cladding are technically all now worth £0.

But, he stresses, if there is a fire, Leanne and her neighbours would have no financial support afterwards.

Now, insurance for buildings with cladding is a real issue at the moment for leaseholders.

Once fire-safety problems are found, many report their premiums rocketing by 3, 4 even ten times what they had before.

As insurers are, understandably, very nervous after Grenfell about backing buildings with such faults.

But this idea of someone’s home being so dangerous, that they cannot get any fire insurance at all, should rightly scare many of us.

Particularly, as we are seeing more and more buildings fail the EWS1 form, and more and more fire safety issues are being found in our country’s high rise housing stock.

Nick Ferrari confronts the Housing Secretary over unsellable homes due to cladding

The building's owners, Artisan H2 told LBCthey employ the services of a professional broker and through the broker became aware that cover for two of the blocks at Albion Works was being removed by the original insurer, NIG.

They said: "This notification was provided very close to the renewal date. We are informed that the insurance market has hardened significantly in recent times and getting cover of any description has been extremely difficult. We worked hard, alongside our Managing Agent, to obtain cover and after numerous discussions, we were able to obtain cover, but without fire cover.

"We are committed to ensuring that the buildings are fully insured and we continue in daily discussions with a number of brokers in order to obtain full cover as quickly as possible.

"We appreciate the concern that this situation is causing, indeed as leaseholders of properties within the blocks we share the concern of our follow leaseholders. We are working day and night to obtain the best possible cover. We will keep all parties updated as soon as there is any movement on the insurance position."